This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Wednesday. This is TheStreet’s Stock Market Today for Jan. 14, 2026. You can follow the latest updates on the market here in our daily live blog.

Update: 4:04 p.m. ET

Closing Bell

The U.S. markets are now closed for the day.

Today’s biggest story — Greenland — appears to have been left largely unturned on Wall Street today. Perhaps they think that the President is still joking (like he was joking about tariffs or other policies, right?) Maybe they suspect that, “Nothing ever happens.” Instead, the market is digesting bank earnings — or selling the news, rather.

Banks more or less met expectations, but have been met with a collective shrug from the market. JPMorgan’s reported Tuesday, while Bank of America, Wells Fargo, and Citigroup rounded out today.

The results also come at a trying time for the broader financial sector: the President’s recent threats to cap credit card interest rates at 10% for one year, which has jolted the sector. Over the last five sessions, the SPDR Financials have fallen 2.33%.

Their decline is by no means singular; tech stocks have also been pulling back, leading the S&P 500 and Dow to decline from recent records.

The Nasdaq (-1.00%) and S&P 500 (-0.53%) have been worst-situated from the decline in tech and financials, while the Dow (-0.09%) has managed to pick up some slack from a row of negative trading days.

For the S&P 500, that’s the first back-to-back decline of 2026.

In fact, it leaves just the Russell 2000 (+0.70%) as the sole gainer, a sign that small caps might be continuing to catch up amid the row of recent economic reports.

Update: 1:52 p.m. ET

Midday Update

We’re now a little past midday, U.S. stocks are mostly skewed to the downside. The Nasdaq (-1.45%) is off more than one percent, while the S&P 500 (-0.89%) isn’t far behind as tech stocks continue to get hammered and banks face steeper sell-offs. The Dow (-0.37%) is also still underwater.

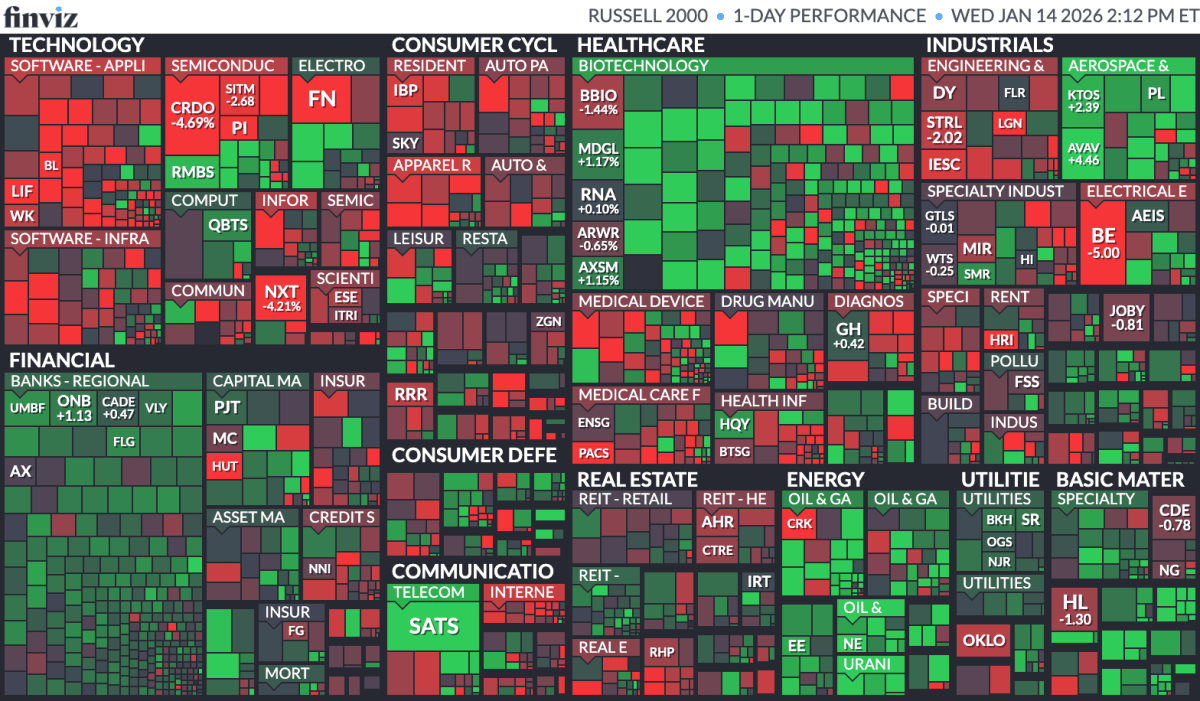

That leaves just the Russell 2000 (+0.11%), America’s small cap index, in the green for the moment. The bright spots include health care, some industrials, energy stocks, and utilities, among others. There’s also some green coming from regional banks:

The performance in small caps might help to explain why the market is up, but the big benchmarks are down: 51.8% (2,865) U.S. issues are advancing against 45.3% (2,504) in decline.

That said, here are the top and bottom 20 movers on the stock market today with at least a $2 billion market cap:

Winners

Among notable stocks making moves today are Critical Metals Corp (+33.84%), which issued a press release indicating that it achieved “high-grade results” at its Greenland mining project.

InfoSys (+9.16%) is the largest gainer of the day, rising after raising its revenue expectations, stirring hopes for a rebound in India’s IT sector. Also among large names: Nutrien (+7.6%, upgrade by Morgan Stanley) and LyondellBasell Industries (+7.36%, trading up in sympathy with the energy sector).

As aforementioned about the Russell, biotech stocks are really making a stand today as well, with Viking Therapeutics (+14.8%, weight loss drug speculation), Erasca Inc. (+10.53%, H.C. Wainwright upgrade), and Terns Pharmaceuticals (+9.43%, JPM conference murmurs) among the best-performing biotechs of the day.

Losers

In notable decliners, software stocks are leading the pack again today, with neobank Dave (-10.6%), Navan (-10.2%), and Unity Software (-8.99%) leading the way. There’s also EV automaker Rivian (-9.26%), AI REIT Fermi (-7.57%), and athleisure company Peloton (-6.99%) among others.

In larger firms, Applovin (-9.49%), Intuit (-6.96%), Shopify (-6.57%), and Airbnb (-6.26%) are all in decline.

Update: 10:02 a.m. ET

Opening Bell

The U.S. markets are now open for the day.

A hotter-than-anticipated PPI report weighed on stocks in the premarket, but it appears that some of those concerns are starting to abate.

About 30 minutes after the market open, the Russell 2000 (+0.15%%) is out in front, briefly recovering some of its morning losses. However, it appears to be paling back. The Dow (-0.16%) has shared a similar trajectory of decline and recovery in the opening, but currently remains in decline on the day.

Then, there’s the S&P 500 (-0.53%) and Nasdaq (-0.86%), which are both getting hammered this morning as tech-exposed names tumble. Broadcom (-4.02%), Oracle (-3.16%), and Nvidia (-2.59%) are among the prominent decliners, while other tech giants like Tesla (-1.99%), Amazon (-1.81%), and Meta (-1.77%) are also facing declines under two percent.

Really, the only pocket of stocks that seems to be winning today are energy and consumer defensive. For evidence of that, here’s the S&P 500, which is retreating from its recent records, covered in a shade of red today:

Meanwhile, continuous futures in gold (+0.23% to $4,609.50) and silver (+4.69% to $90.215) continue to impress. Silver set a new all-time high (at ~$92), while gold isn’t far off another one of its own (at $4.65K).

Here are some of the other stories making headway this morning (which will be updated as the morning goes on):

Supreme Court Does Not Rule on Tariff Case

First, traders were banking on Friday. Then, they were banking on today. Ultimately, they’ll have to wait just a little longer for the Supreme Court’s decision on tariffs, as well as another controversial case involving the Voting Rights Act (VRA).

It’s very likely that the delay simply means that other decisions are lined up ahead of it. SCOTUSBlog’s Amy Howe said that one decision release today took “almost exactly three months, and it was an 11-page majority opinion followed by two concurring opinions.”

The Court heard arguments in the Trump tariff case in November before its holiday recess. We’ll be monitoring when the nation’s highest court might actually release the decision.

Meta Conducts Layoffs in Metaverse Division

Once the company’s namesake, Meta is now laying off 10% to 15% of its staff — or over 1,000 jobs — in its beleaguered (and expensive) metaverse division.

The recent layoffs come after the firm indicated it would pale back efforts in its Reality Labs division to invest in the company’s pivot towards AI, another burgeoning technology which remains unprofitable and costly for the company.

That, of course, could eventually change — but the similarity between the two businesses is telling. Both highly-aspirational, both still highly unprofitable. We’ll see if Meta, a first-mover in AI, will be able to make its big bet pay off.

Greenland Controversy Moves Troops

Post-Venezuelan incursion, President Donald Trump’s imperial ambitions appear to be serious business.

After meeting with Vice President JD Vance and Secretary of State Marco Rubio, the Prime Minister of Greenland stressed the seriousness of the situation, underscoring that he was “unable” to change the American point-of-view on the Greenland situation.

The idea seems to have stemmed not just from pure resource speculation, but from an elite class of Trump voters who have taken a vested interest in building “freedom cities” in the region.

The President has indicated his desire to purchase the frigid land for its resources, even though it’s not for sale. That has inspired fears that he might choose to simply invade and take the land, creating new geopolitical turbulence.

This revelation has prompted European countries to send resources to defend the land against the U.S., with Germany, Sweden, and Norway sending troops to the country.

Update: 8:46 a.m. ET

A.M. Update

Good morning. Here’s what is on deck for today:

Tariff Decision Incoming?

Today is widely expected to bring the Supreme Court’s decision on President Donald Trump’s emergency power tariffs. Prediction markets have put low odds on the president’s crowning policy surviving the majority-conservative court, especially after losing in lower courts. A loss would likely mean that the administration would have to refund billions in collected tariff revenue. How? That’s still a big unknown.

Despite that, Trump has indicated he will entertain alternative ways to impose tariffs to promote American economic interests at home and abroad. That could imposing tariffs under laws already on the books.

Economic Events + Data

Today is set to be as busy a slate for economic data as we can remember, with the Producer Price Index for October and November set to be reported, along with Retail Sales, Existing Home Sales, and other datapoints. In addition, various Fed leaders such as Anna Paulson (Chicago Fed), Raphael Bostic (Atlanta), Neel Kashkari (Minneapolis), and John Williams (New York) are set to make remarks.

Here is the slate:

Earnings Today

In addition, we’ve been perusing a number of bank earnings this morning, including from Bank of America, Wells Fargo, and Citigroup, among others. Many of them have not been warmly received, even as banks beat estimates.

The SPDR Financial Select ETF is declining for a second consecutive day, down about 1% as of this writing. That said, here’s what we got up to this morning, updated with some of the early morning moves:

After the close, we’ll get about three more reports from firms worth at least $1 billion. Here’s those names on the P.M. side: