Warren Buffett just set a pretty high bar for anyone in the second half of life, according to CNBC’s latest special on the Berkshire Hathaway legend.

He says you should be “wiser” in the second half of your life than the first, and that “if things have worked well for you, you should be a better person” as you age, according to CNBC’s social clip promoting the special “Warren Buffett: A Life and Legacy.”

I hear that as a direct challenge to people who are past the hustle years and starting to think more about security, legacy, and what all this saving has really been for.

The two‑hour CNBC special focuses on how Buffett’s views on business, philanthropy, and life have evolved over the decades, rather than just how big his net worth has become, according to a CNBC media alert.

For your money, that “be wiser and better” line translates into something very concrete: You cannot run your retirement dollars the same way you ran your early‑career portfolio and expect a happy ending, according to Dunham & Associates’ financial‑planning research on retirement risks.

What Buffett’s “second half” lesson really means for your finances

Buffett’s own story shows that the second half of your financial life can be dramatically more powerful than the first. Roughly 99% of Buffett’s wealth showed up after age 65 because compounding had decades to work, according to author Morgan Housel’s comments in a CNBC report.

Housel wrote that “Buffett’s skill is investing, but his secret is time,” according to CNBC’s summary of his book “The Psychology of Money.”

Shutterstock

That is the first uncomfortable truth for late‑life money planning.

If you have saved and invested steadily, your current net worth probably reflects 30 or 40 years of small decisions, habit, and luck far more than your raw stock‑picking skill, according to research on long‑term compounding discussed by CNBC and other outlets.

Buffett has described compound interest as a snowball that needs a very long hill, saying the trick is to start young or live to be very old.

Your job in the second half of life is not to prove you are as brilliant as Buffett. It’s to stop doing things that shorten that hill or blow up the snowball just as it gets big enough to matter.

Related: Warren Buffett’s net worth: A look at his fortune in retirement

The new biggest investment risk: wrecking the snowball

When you are 25, a bear market is a buying opportunity. When you are 65 and withdrawing from your investments, a bear market can be a permanent setback, according to retirement planners.

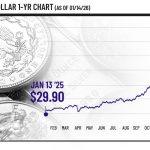

Retirement researchers call this “sequence risk,” the danger that bad returns early in retirement, combined with withdrawals, can drain your portfolio faster than you expect, according to Investopedia.

A 2024 analysis from Dunham & Associates showed that a portfolio with lower average returns but strong early performance can beat a higher‑return portfolio that gets hit with losses early in retirement while withdrawals are happening, according to the firm’s sequence‑risk explainer.

Related: Buffett leaves, and Berkshire investors waste no time reacting

Behavioral‑finance experts say there is a second layer of risk.

Investors often buy when markets are rising and sell when markets fall, which is the exact opposite of what long‑term compounding needs, according to behavioral‑finance expert Bradley Klontz, who spoke to CNBC about investor behavior.

The Institute of Financial Wellness has warned that fear, greed, and overconfidence can amplify sequence risk for retirees, pushing them into poorly timed moves that undermine decades of saving, according to its 2024 retirement‑planning guidance.

If you take Buffett’s “be wiser” line seriously, the second half of your financial life is about building a system that protects you from your own worst impulses when markets get loud, according to these experts.

Related: Greg Abel’s net worth: Buffett’s successor’s wealth as Berkshire’s CEO

How to apply Buffett’s late‑life money lesson to your investments

Here is where Buffett’s message becomes most useful for you.

He has long argued that most people should keep things simple, according to years of Berkshire Hathaway meeting transcripts and CNBC interviews.

Buffett has said that an S&P 500index fund is a perfectly sensible default for ordinary investors and that his own estate plan calls for 90% of his widow’s portfolio to go into a low‑cost S&P 500 fund and 10% into short‑term government bonds, according to CNBC’s reporting on his will instructions.

Other advisors back that tilt toward simplicity as you age.

More Warren Buffett

- Warren Buffett’s Berkshire Hathaway shares mortgage warning

- Warren Buffett’s most insightful investing quotes as he celebrates retirement

- Warren Buffett’s best investments: 5 companies that rewarded him enormously

- How to read like Warren Buffett (plus 4 books to start with)

- Analysis: Why ‘cheap stocks to buy now’ is the wrong investing idea

- The 3 biggest mistakes Warren Buffett made as Berkshire CEO

Everyday investors should “start early and consistently contribute, even if the amounts are small,” then stay calm through market swings instead of trying to outsmart them, according to Salem Investment Counselors president David Rea in comments to CNBC.

Human nature drives many people to chase what feels good now instead of what builds wealth over decades, Klontz told CNBC.

Yet in the second half of life, you do not have as many decades left to recover from those emotional detours, according to retirement‑planning experts such as Dunham & Associates.

That is where Buffett’s line about being a “better person” comes in for your finances.

Being “better” in money terms means:

- You build an investment plan that still grows but protects your basic retirement income, even if markets stumble early, according to research on sequence risk from Investopedia and Dunham & Associates.

- You accept that not every dollar has to be maximized for return; some dollars are there to buy peace of mind for you and your family, according to behavioral‑finance commentary from the Institute of Financial Wellness.

- You start defining “winning” less as beating the market and more as not having to panic‑sell or move in with your kids at age 82, according to retirement‑security research cited by Investopedia.

That is a very different scorecard than the one you probably used in your 30s.

Related: Dave Ramsey’s 5 best retirement tips

The practical, retirement-ready moves you can make now

If you want to act on Buffett’s late‑life lesson instead of just liking the quote on social media, here are three concrete steps I recommend to protect your retirement.

- Stress‑test your retirement plan for bad timing. Model what happens if your portfolio drops 20% in the first few years of retirement while you are already withdrawing.

- Build “wiser” guardrails. Keep one to three years of essential expenses in cash or short‑term bonds so you are not forced to sell stocks low, and adjust withdrawals after bad market years.

- Simplify instead of chasing complexity. Consolidate old accounts, focus on a small mix of diversified, low‑cost funds, and stop tinkering every time markets move or headlines get loud.

If you do those three things, you are not just managing a portfolio in your second half of life; you are actively protecting a lifetime of work and giving your future self fewer reasons to worry.

Related: Berkshire CEO will get a salary Buffett refused for decades